Digital Audit - (Standard Audit File Tax SAF-T/ GDPdU) within Oracle E-Business Suite

In its letter of 14 November 2014 (principles regarding the proper keeping and preservation of books,records and documents in electronic format and regarding data access (GoBD), the fiscal authority has replaced the existing BMF letters GDPdU of 16 July 2001 and GoBS of 7 November 1995 and re-regulated the GoBD.

The new GoBD apply to all companies under a legal obligation to keep records, but also to all taxable persons who determine the taxable result using the cash method of accounting and all entrepreneurs as defined in the value-added tax act who are using an electronic accounting method for this. The new GoBD have an influence on all digital book-keeping, ERP systems and the associated IT-supported business processes.The fiscal authority will check observance of the GoBD at thelatest in the context of the next tax audit.

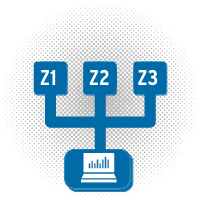

The principles for these requirements have not changed since their introduction and the definition of which data are ‘data relevant for tax purposes’ is now largely established. While the right to digital access was used relatively rarely in the early years, a current study involving 230 companies showed that digital access was requested in fully 81% of all audits for the years 2010 and 2011. Furthermore, it is becoming clear that so-called Z3 access (data relevant for the audit have to be provided in a special format on a data carrier) is becoming the de facto standard.

Insofar as this has not already occurred, the Oracle E-Business Suite has to be configured to ensure that the three possible access methods are promptly available for the next audit in order to avoid problems during the audit or even the assessment of late payment penalties.

Requirements for the implementation of SAF-T/ GDPdU within the Oracle E-Business Suite

Within the E-Business Suite, the technical prerequisites for the following three access scenarios have to be established:

- Z1 access – the auditor accesses the company’s digital data directly:

Since the auditor is granted direct access to the system, the definition of special ‘Auditor’ access rights has to ensure that read access is provided to information relevant for tax purposes for the accounting unit subject to German law. With a few “tricks” within the Oracle EBS standard, such access rights (-> read only access to entries relevant for tax purposes for a specific period and a specific accounting unit) can be readily implemented with a reasonable amount of effort. - Z2 access – the auditor accesses the data indirectly with the support of a company employee:

This type of access does not require any modifications, since either the ‘Auditor’ access rights or the access rights of the respective employee can be used. - Z3 access – the auditor is provided with the data relevant for the audit in a special format on a data carrier, so they can be evaluated with the IDEA audit software used by the fiscal authorities.

Implementing this requirement is somewhat more complex and, depending on the version of the E-Business Suite, requires minor modifications and adaptations.

Certified GoBD/ GDPdU Interface Digital Audit for Z3 access to Oracle E-Business Suite

For this purpose, PDG developed its own Oracle E-Business Suite Interface. This extension does not modify the E-Business Suite setup and is already being used successfully by more than 150 customers.

Oracle Financials Setup Review

A large number of US-based international companies are using Oracle ERP Software to serve their subsidiaries in Germany. The setup for the German subsidiary is usually determined by either a global or a European setup template. A global or European setup template is not always capable of dealing with all of these specific GoBD (Generally accepted accounting principles) requirements of the German tax authorities. As a direct result, many German subsidiaries face significant issues during their annual audit.

We offer a review of our finance/ tax setups to ensure they are proper according to GoBD requirements ( GL, AP, AR, FA, CM, E-Tax) to proactively resolve GoBD-issues. For more information, please contact us.