Transfer E-Invoice to Customer from Oracle E-Business Suite

as SaaS or AddOn solution

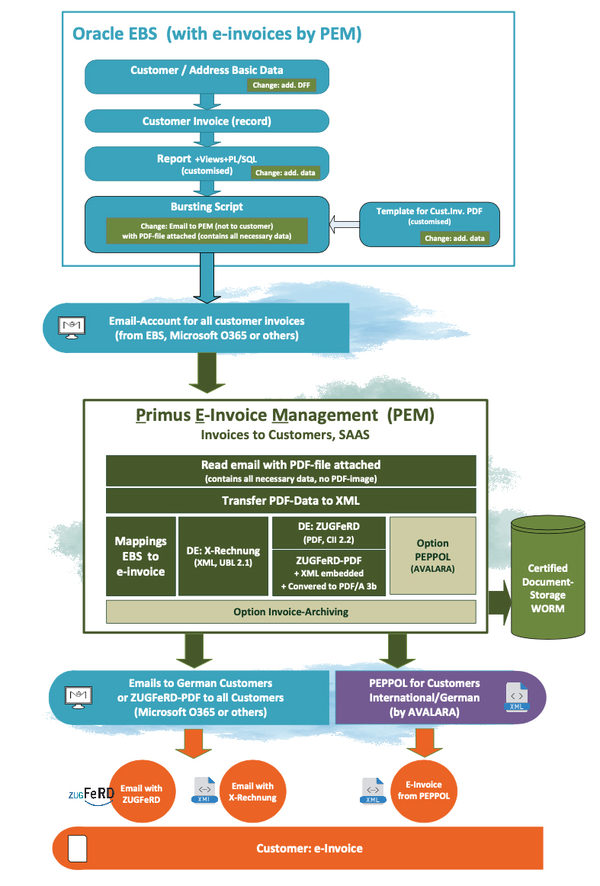

With Primus E-Invoice Management (PEM) solution, PRIMUS makes it possible to fulfill the legal requirements for customer invoice transfer from the Oracle E-Business Suite.

Primus E-Invoice Management (PEM) creates the e-invoice from the existing PDF invoice and sends it to the customer by email or via PEPPOL.

Primus E-Invoice Management can be used either as a Software as a Service solution or as an AddOn.

Procedure for Transfering Customer E-Invoices with PEM

- The invoice data is generated as usual in the E-Business Suite in Accounts Receivable.

- The existing invoice print request continues to generate the PDF invoice. All implemented special logics are still active. However, the PDF invoices are no longer sent immediately to the customer by email, but to a new, internal email address.

- Additional customer master data is required for processing as an e-invoice. This can either be provided by EBS and transmitted via an extension to the PDF invoice or this e-invoice master data can be managed via PEM masks.

- PEM extracts the data from the PDF file, recognises the required format and adds the XML data. The desired invoice (ZUGFeRD, X-Rechnung, PEPPOL) is created.

- The invoice files are archived using the "Invoice- Archiving" option.

- PEM transmits the corresponding emails (with ZUGFeRD or X-Rechnung) via the (new) internal mailbox or the XML-invoice-data via PEPPOL to the customer

The current legal regulations on e-invoicing in Germany:

On 22.03.2024, the Federal Council approved the new Growth Opportunities Act.

This makes electronic invoicing in the B2B sector mandatory for German companies as part of the EU Directive "Value Added Tax in the Digital Age" - ViDA". The law states that companies must be ready to receive electronic invoices from January 1, 2025, while the submission of electronic invoices will initially be voluntary in 2025 and 2026 and then only mandatory from January 1, 2027.

Electronic invoices are all invoices that are compatible with the "CEN format EN 16931", e.g. standards such as "XStandard" or "ZUGFeRD". PDF invoices are not electronic invoices.

This means that companies in Germany must prepare their ERP system to transfer electronic invoices from January 1, 2027.

Your Advantages

- Compliance with the legal requirement to create electronic invoices for B2B customers in Germany from 1 January 2027

- Customer invoices as X-invoices or ZUGFeRD can already be sent by email or via PEPPOL.This gives your customers the advantage of being able to import these invoices automatically.

Customers can process ZUGFeRD invoices „manually“ without any problems.